Stocks

Stocks, also known as equities, represent ownership shares in a corporation. When you purchase stocks, you become a shareholder in that company, giving you certain rights, including voting at shareholder meetings and receiving dividends if the company distributes them. Investing in stocks can offer the potential for significant returns over the long term, but it also comes with risks, such as market volatility and the possibility of losing your investment.

How Stocks Work?

Stocks function as a way for companies to raise capital by selling ownership stakes to investors. When a company decides to go public, it issues shares of stock through an initial public offering (IPO). Investors can then buy and sell these shares on stock exchanges, such as the New York Stock Exchange (NYSE) or the Nasdaq.

The price of a stock is determined by supply and demand in the market. If more investors want to buy a stock than sell it, the price will increase. Conversely, if more investors want to sell than buy, the price will decrease. Various factors influence stock prices, including company performance, economic conditions, industry trends, and investor sentiment.

Investors can profit from stocks in two main ways: capital appreciation and dividends. Capital appreciation occurs when the value of a stock increases over time, allowing investors to sell their shares at a higher price than they paid. Dividends are periodic payments made by some companies to shareholders, typically as a portion of their profits.

Risks of Investing in Stocks:

While investing in stocks offers the potential for high returns, it also involves various risks that investors should be aware of:

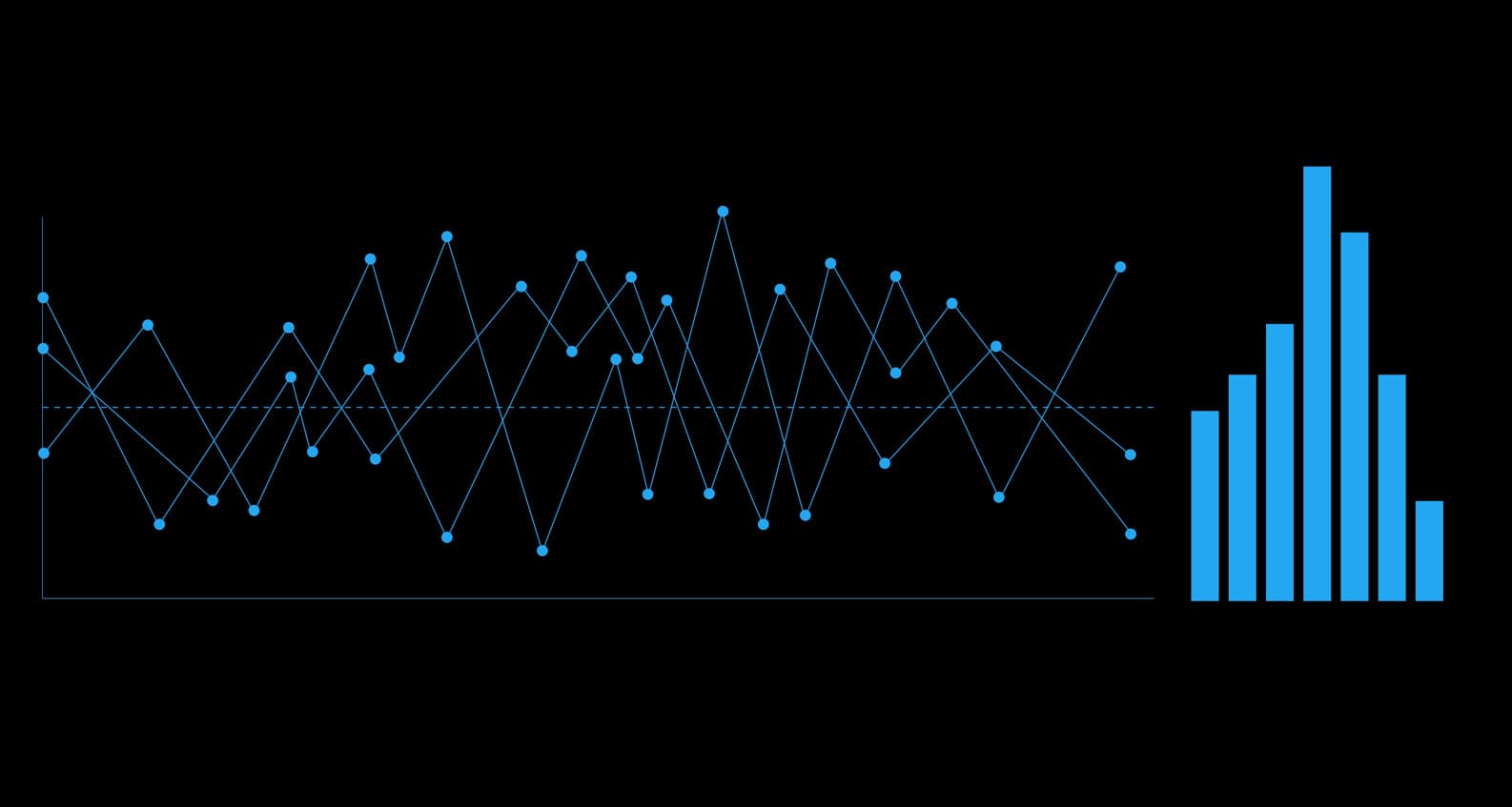

- Market Volatility: Stock prices can fluctuate widely in response to market conditions, economic factors, and investor sentiment. This volatility can lead to significant short-term losses for investors.

- Company Risk: Individual companies may face specific risks related to their industry, competitive position, management team, or financial health. Poor performance or unexpected events can cause a company's stock price to decline.

- Systemic Risk: Events such as economic recessions, geopolitical tensions, or financial crises can impact the entire stock market, causing widespread declines in stock prices.

- Liquidity Risk: Some stocks may have low trading volumes, making it difficult to buy or sell shares at desired prices. Illiquid stocks can lead to delays or higher transaction costs for investors.

- Regulatory Risk: Changes in government regulations or policies can affect industries and individual companies, potentially impacting their stock prices and profitability.

It's essential for investors to carefully assess these risks and diversify their portfolios to help mitigate potential losses. By spreading investments across different asset classes and industries, investors can reduce their exposure to any single stock or market risk.

Types of Stocks:

When investing in stocks, it's important to understand the different types available. Here are some common categories:

- Common Stocks: These are the most typical type of stocks that represent ownership in a company. Common shareholders have voting rights and may receive dividends, although dividends are not guaranteed.

- Preferred Stocks: Preferred stocks often pay fixed dividends at regular intervals, similar to bonds. They have priority over common stocks in terms of dividend payments and assets in the event of liquidation but generally do not have voting rights.

- Blue-Chip Stocks: Blue-chip stocks belong to well-established companies with a history of stable earnings and dividends. They are typically considered safe investments and are known for their reliability.

- Growth Stocks: Growth stocks belong to companies that are expected to grow at an above-average rate compared to other companies in the market. These stocks may reinvest most of their earnings into expansion rather than paying dividends.

- Value Stocks: Value stocks are undervalued by the market, trading at a lower price relative to their fundamentals, such as earnings or book value. Investors believe these stocks have the potential for price appreciation.

- Income Stocks: Income stocks are known for their consistent dividend payments, making them attractive to investors seeking regular income streams. These companies are often stable and mature, with predictable cash flows.

- Penny Stocks: Penny stocks are low-priced, speculative stocks that trade at a relatively low market capitalization. They are often associated with small companies and carry higher risk due to their volatility and lack of liquidity.

Each type of stock has its own characteristics and potential risks and rewards, so investors should carefully consider their investment goals and risk tolerance before choosing which types of stocks to include in their portfolios.

Strategies for Investing in Stocks:

When investing in stocks, it's essential to have a well-thought-out strategy to maximize returns while managing risk. Here are some common strategies:

- Buy and Hold: This strategy involves purchasing stocks with the intention of holding them for the long term, regardless of short-term market fluctuations. Investors believe in the long-term growth potential of the companies they invest in and focus on fundamental analysis rather than timing the market.

- Value Investing: Value investors seek out stocks that are trading at a discount to their intrinsic value. They look for companies with strong fundamentals, such as low price-to-earnings ratios or high dividend yields, and believe that the market will eventually recognize the stock's true worth.

- Growth Investing: Growth investors focus on companies with the potential for above-average earnings growth. They prioritize stocks of companies in expanding industries or those with innovative products or services. Growth investors are willing to pay higher valuations for stocks with strong growth prospects.

- Dividend Investing: Dividend investors prioritize stocks that pay regular dividends to shareholders. They seek out companies with a history of stable dividend payments and dividend growth. Dividend investing can provide investors with a steady income stream and potentially higher total returns over time.

- Index Investing: Index investors seek to replicate the performance of a specific market index, such as the S&P 500, by investing in index funds or exchange-traded funds (ETFs). This passive investing approach offers diversification across a broad range of stocks and tends to have lower fees compared to actively managed funds.

- Sector Rotation: Sector rotation involves shifting investments among different sectors of the economy based on economic cycles and sector performance. Investors may overweight sectors that are expected to outperform in the current economic environment and underweight or avoid sectors that are expected to underperform.

Regardless of the strategy chosen, investors should conduct thorough research, diversify their portfolios, and regularly review their investments to ensure they align with their financial goals and risk tolerance.

Where Can You Buy Stocks?

There are several options available for buying stocks, catering to different preferences and levels of expertise:

- Stock Brokerage Firms: Traditional brokerage firms, both online and offline, offer platforms for buying and selling stocks. These firms provide access to a wide range of stocks listed on major exchanges and often offer research tools, educational resources, and investment advice.

- Online Brokerage Platforms: Online brokerage platforms have gained popularity for their convenience and lower fees compared to traditional brokerage firms. Investors can open accounts online, access trading platforms from their computers or mobile devices, and execute trades with ease.

- Robo-Advisors: Robo-advisors are automated investment platforms that use algorithms to build and manage diversified portfolios for investors. Some robo-advisors offer the option to invest in individual stocks alongside other asset classes, providing a hands-off approach to investing.

- Direct Stock Purchase Plans (DSPPs): Some companies offer DSPPs that allow investors to buy shares directly from the company without going through a brokerage firm. These plans typically have low fees and may offer discounts on share prices, but they may have limited investment options.

- Dividend Reinvestment Plans (DRIPs): DRIPs allow investors to automatically reinvest dividends paid by a company to purchase additional shares, often at discounted prices. DRIPs can be a cost-effective way to accumulate shares over time and compound returns.

Before choosing a platform or method for buying stocks, investors should consider factors such as fees, investment options, research tools, and customer support to ensure it aligns with their needs and preferences.

Comments:

Ava Martinez

Benjamin Lee

Sophie Johnson

Michael Johnson